What is a stock market?

The stock market refers to a network of exchanges. The stock market is the place

where regular activities of buying and selling publicly listed company shares take

place.

In India, the prime stock exchanges are the National Stock Exchange (NSE) and

the Bombay Stock Exchange (BSE).

How does the stock market work?

Individual and institutional investors come together on stock exchanges to buy and sell shares

in a public venue.

Share prices are set by supply and demand as buyers and sellers place orders.

Order flow and bid-ask spreads are often maintained by specialists or market makers to

ensure an orderly and fair market

The people involved in the stock market

There are mainly Companies that issue shares, Investors who buy and sell shares, Regulators, Credit rating agencies (issues rating of the companies), and Traders.

Role of Investors

An investor is a person who allocates capital or purchases shares of the company for a long time with the expectation of a future financial return (profit). There are multiple types of investors retail investors, intuitional investors, hedge funds, groups of investors, Banks, insurance companies etc.

Role of Company’s

The purpose of companies (borrowers) issuing stocks and selling them to the public (lender or investor) is to raise their funds for financing their spending.

Role of Regulators

The role of regulators is to regulate the Stock Exchange activities and ensure healthy development in the financial market. The regulatory body for the stock market is the Securities and Exchange Board of India (SEBI)

Type of issues in the stock market

There are mainly 2 types of issues

Initial public offering (IPO)

Further public offer (FPO)

What’s an IPO and FPO

Initial public offer (IPO): When an unlisted company makes either a fresh issue of shares or convertible securities or offers its existing shares or convertible securities for sale or both for the first time to the public, it is called an IPO.

Further public offer (FPO) or follow on offer: When an already listed company makes either a fresh issue of shares or convertible securities to the public or an offer for sale to the public, it is called a FPO.

How do companies issue shares in the market?

As per the SEBI Website (sebi.gov.in)

Shares of a company registered in India can be issued to the general public (with SEBI approval) by a Limited Company or can be issued to persons and entities comprising of friends, relatives, business partners, etc

How do investors invest in the stock market?

Investors can invest in the share market by opening a Demat account or through the brokers

Investments in the primary share market are through an Initial Public Offering (IPO). After a company receives all the applications made for an IPO by investors, the applications are counted, and shares are allotted based on demand and availability. To invest in both primary and secondary markets.

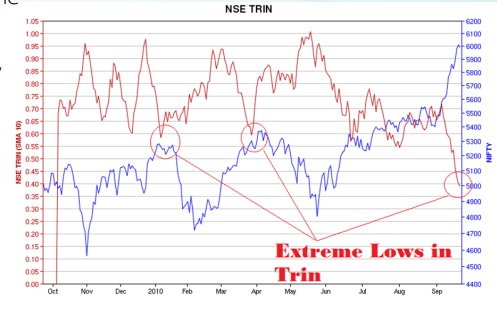

The type of indicators in the stock market

Most stock market indicators are created by analysing the number of companies that have

reached new highs relative to the number that created new lows, known as market breadth since

it shows where the overall trend is headed

The two most common types of market indicators are Market Breadth and Market Sentiment

The difference between the indictors

Market Breadth indicators compare the number of stocks moving in the same direction as a larger trend. For example, the Advance-Decline Line looks at the number of advancing stocks versus the number of declining stocks.

Market Sentiment indicators compare price and volume to determine whether investors are bullish or bearish on the overall market

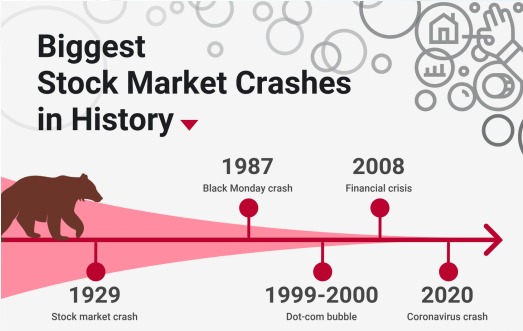

What is a stock market crash?

A stock market crash is defined as a quick and dramatic drop in stock prices over a large segment of a stock market, resulting in a considerable loss of paper wealth. Panic selling and underlying economic reasons drive crashes. They are frequently associated with speculative and economic bubbles

Biggest stock market crashes in history

Reason for stock market crash?

How to predict a stock market crash?

Stock market crashes don’t happen overnight. The 2008 financial crisis foundation was layered in the 80s. The fall of Lehman Brothers was just an initiating point of how severe the crisis is Dr Michael Burry figured it out in early 2016, predicted and shorted (bet against it) the housing market.

To predict a stock market crash is a hassle as it involves multiple moving variables in the process for example the economy of the country, political situation, geo-politics etc.

How to predict a stock market crash?

There are 2 ways to predict a stock market crash is to use Indicators or use multiple mathematical models

The indicators can be

Rampant Speculation: The anticipation of future price movement based on a belief the market has inaccurately priced the stock

Low Growth Rates: A decrease in an economy’s GDP during any quarter.

Peak Valuations: Share Prices reach an all-time high of a company, Index’s

What is stock market correction?

A correction is a decline of 10% or greater in the price of a security, asset, or financial market. Corrections can last anywhere from days to months, or even longer.

While damaging in the short term, a correction can be positive, adjusting overvalued asset prices and providing buying opportunities

How to predict stock market correction?

It is always impossible to predict when a correction will happen There are a few simple strategies which can help to predict.

YIELD CURVE: A yield curve refers to the overall movement of short and long-term treasury bonds. In a normal situation, the yield of a long-dated bond will be higher than that of a shorter bond. That’s because the extreme future is relatively difficult to predict.

How to predict stock market correction?

FEAR AND GREED INDEX: The Fear and Greed Index, was based on the logic that excessive fear tends to drive down share prices, and too much greed tends to have the opposite effect.

IRRATIONAL EXUBERANCE: Irrational exuberance is unfounded market optimism that lacks a real foundation of fundamental valuation, but instead rests on psychological factors

Stock Market FAQ

What is a Bear Market?

It refers to a period in which the prices of equity shares fall consistently. It’s usually a

the condition where share prices fall by 20% from recent highs.

What is Bull Market?

An opposite of a bear market, a bull market is a market where the prices of the stocks are

increasing over a prolonged period of time. A single stock and a sector can be bullish at one

time and bearish at another time.

What is Call Option?

In this, the buyer of the option gets the right but not the obligation to purchase the

underlying asset at a specified price and time.

Type of market indicators

The two most common types of market indicators are Market Breadth and Market Sentiment

Reference

https://www.grin.com/document/170223

https://www.sebi.gov.in/sebi_data/commondocs/subsection1_p.pdf

https://www.indiainfoline.com/knowledge-center/share-market/how-to-invest-in-share-market